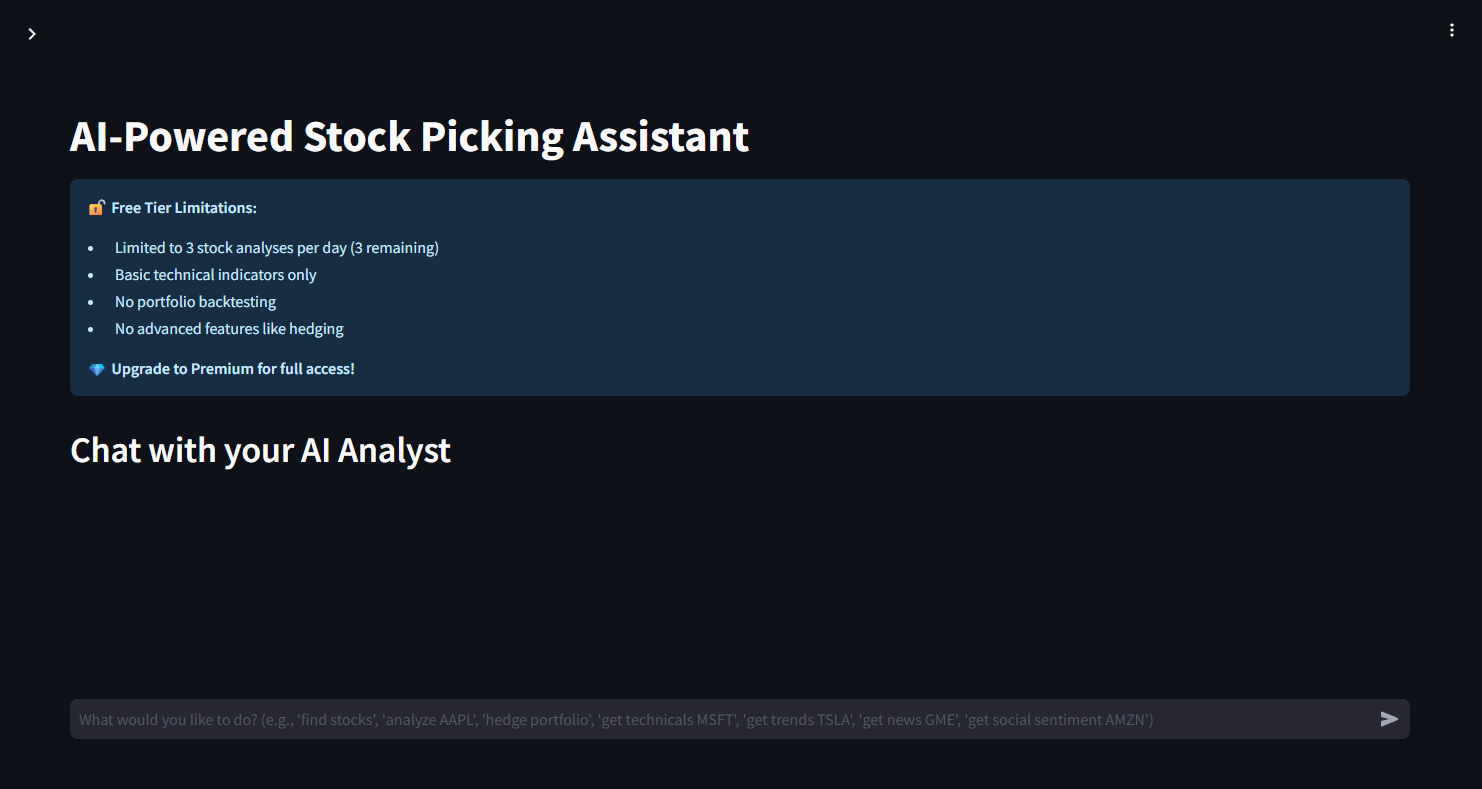

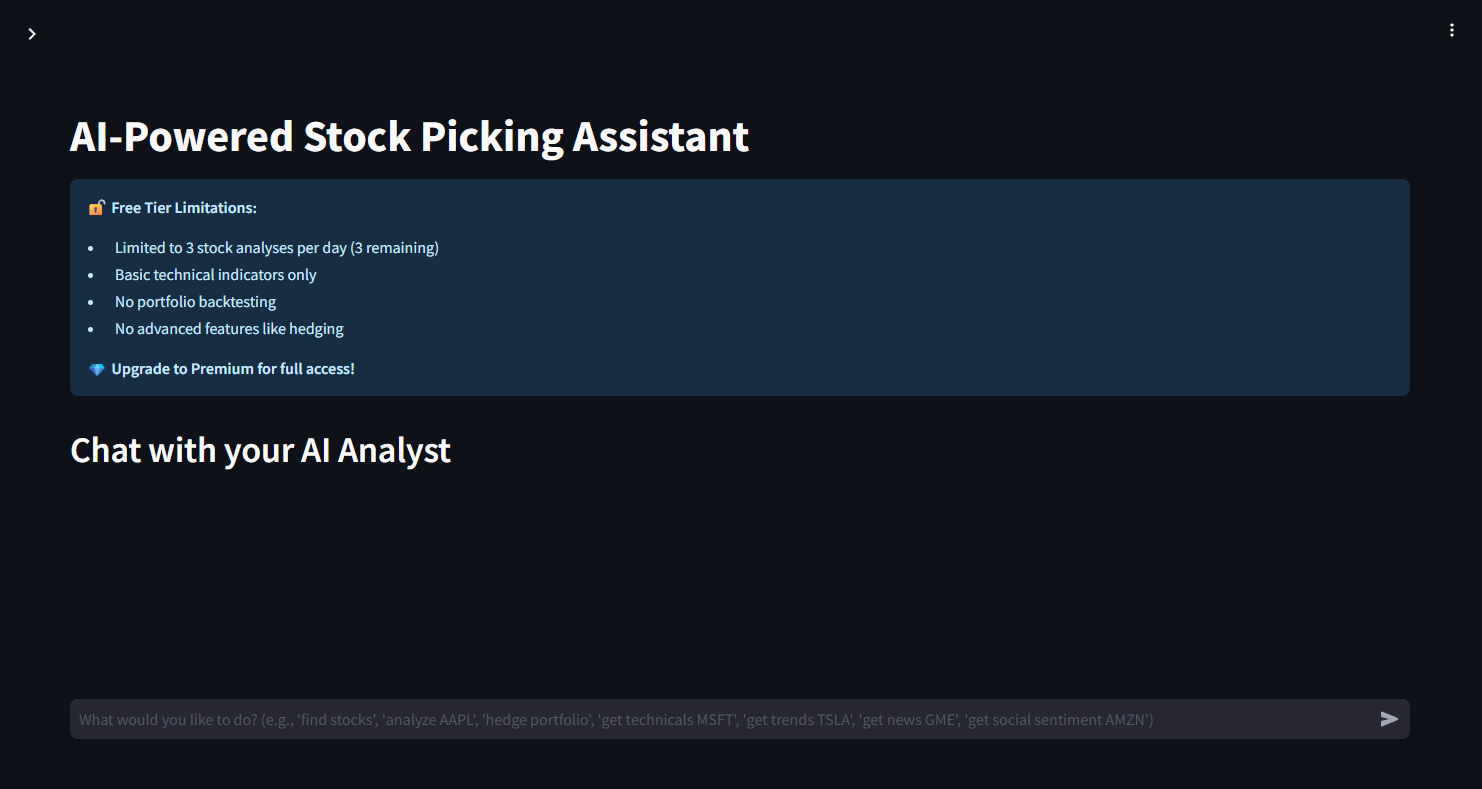

A Look Inside AIvestor

A clean, unified dashboard for all your investing needs.

AIvestor is your all-in-one agent to find, analyze, and trade high-growth small/mid-cap stocks or commodities, bonds, ETFs and even crypto. All from a simple chat interface.

POWERED BY THE MARKET'S SMARTEST APIS

From discovery to execution, AIvestor handles the entire workflow. No more juggling 10 different tabs.

Use natural language to find, analyze, and trade. Ask things like "find new small-cap tech stocks" or "hedge my portfolio".

Our AI agent finds hidden gems and provides clear BUY/SELL/SHORT recommendations with full justification. Get technicals, news, sentiment analysis and trends from Google, news APIs, Polymarket or Reddit.

Love a recommendation? Execute the trade instantly from the chat. Connect your Alpaca account and AIvestor handles the order booking.

See all your trades, current holdings, and portfolio value over time. Our interface makes tracking performance simple.

Test strategies like SMA Crossovers on historical data. See your Total Return, Sharpe Ratio, and Win Rate before you invest real money.

Get an edge. Ask "check house trades for NVDA" to see what politicians are doing. Plus, track key FRED macro indicators all in one place.

A clean, unified dashboard for all your investing needs.

I'm a full-stack developer who built AIvestor to solve my own frustrations with fragmented investing tools. I wanted one place where I could research, analyze, and trade—all powered by AI.

Quant Competitions Achievement

In 2024, I achieved 7th place at Quantiacs, a global quantitative trading competition. With a background in financial software, I built AIvestor to democratize AI-powered investing tools that were previously only available to institutions.

Other Platforms I've Built

Each platform serves thousands of users and taught me about data quality, API design, and developer experience, lessons that are now embedded in AIvestor's DNA.

Connect with me

I'm not just the founder, I'm user zero. I built AIvestor to run my own portfolio. Here are my real-money results from the agent's picks.

My strategy is simple. In June, I asked AIvestor to "find me small-cap stocks in aerospace and nuclear with strong technicals." It scanned the market, news, and even political trades.

It returned Rocket Lab (RKLB) and Cameco (CCJ) as top picks. I then asked it to "find undervalued dividend stocks to hedge." It found Verizon (VZ) and Prysmian (PRYMY).

I reviewed its analysis and executed all four trades in one click via the Alpaca integration. This is 'dogfooding' at its best.

Rocket Lab USA

+42.8%

Since June 2025

Cameco Corp.

+27.2%

Since June 2025

Verizon

+8.1%

Since June 2025

Prysmian Group

+12.5%

Since June 2025

One plan. Unlimited access. No hidden fees.

Connect your own Alpaca account to enable live trading.